It was only a few hours before I went to bed last night that Robinhood stopped its Instant Deposit feature to access crypto, pissing off users -- but now it's worse: they're limiting your purchases on "WSB stocks".

These stocks include GameStop ($GME), AMC ($AMC), BlackBerry ($BB) and Nokia ($NOK) which have all been selling some great returns on investment for people. GameStop in particular which has mooned and caused hedge funds to lose billions of dollars, make worldwide headlines, and disrupt the entire market.

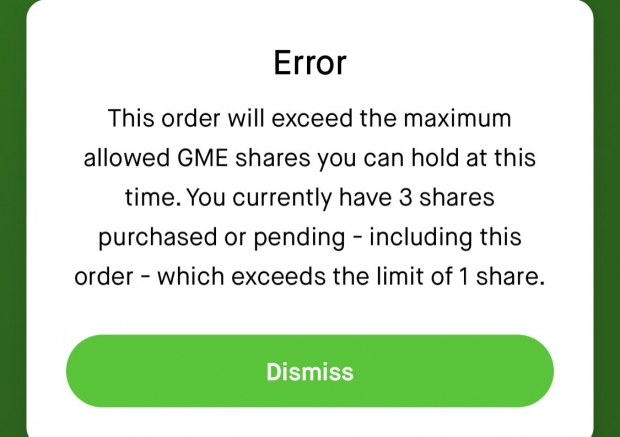

Well, now Robinhood is completely limiting the sales of shares of GameStop ($GME), AMC ($AMC), BlackBerry ($BB) and Nokia ($NOK) to just 1 share per customer at purchase. Stock Market News on Twitter shared the new images, which limits the super-popular shares to 1 purchase per customer at the moment.

The poster notes that there are "no restrictions on Webull" and other platforms.

- Read more: Robinhood hit with class action lawsuit over GME trade restrictions

- Read more: Reddit made r/WallStreetBets private over GameStop stock, back now

- Read more: Discord shuts down /r/WallStreetBets server for 'hate speech' and more

- Read more: GameStop was the most traded equity today, beating Tesla and Apple

- Read more: Reddit is buckling under the pressure of GameStop stock madness

- Read more: This Redditor turned $755K into $48 million thanks to GameStop stock

- Read more: Why GameStop's stock has spiked 671% in a week

- Read more: Reddit trollers + Elon Musk pump GameStop share price to record highs