The PlayStation 5 price hike is the most unpopular decision that Sony has made since the PS3 era. As history repeats itself, Sony faces the very thing that held it back during the Gen 7 console cycle.

Sony has announced a PlayStation 5 price hike in all territories and countries outside of the United States. The reasons are stark and clear: Foreign currencies are falling against the dollar--the Euro dipped below the dollar recently, and is currently break-even; the yen is low, causing PlayStation operating income to drop by -50%--and inflation is forcing consumers to re-think their spending.

The pandemic earnings surge is long gone, and manufacturing costs have risen even as components become more readily available. Everything is getting more expensive and to stay profitable, Sony is passing those costs onto consumers in every market except its most important one: The United States.

Having covered gaming for some 11 years now, I've seen industry trends come and go. Many of them not only stay but repeat themselves. Market leaders are typically swing on a pendulum; Microsoft conquers one gen, Sony conquers the next. This swing of power has changed, though, and history is repeating itself with Sony right now in an interesting way. PlayStation is currently living a unique nightmarish blend of the high-cost PS3 era mixed with the disastrous PR that ultimately handicapped the Xbox One at the beginning of Gen 8.

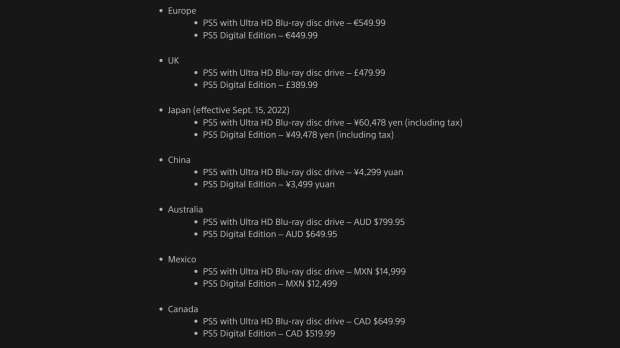

The PlayStation 5's new MSRP.

Sony has inadvertently kicked off the worst kind of console war during a time where the industry is moving away from the self-contained, walled garden platforms. Raising the PS5's price tag shook up the hornet's nest of bad press and user sentiment to such a degree on social media that I was completely reminded of the Xbox One's doomed launch.

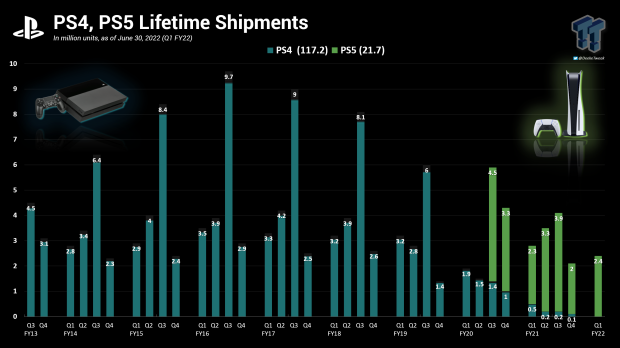

The PS5 isn't doomed, though. Far from it. The console is doing comparatively well with 21.7 million total shipments, and Sony is preparing to ship another 18 million consoles this fiscal year. We have to wonder how the price hike will affect overall sell-through and hardware earnings for the business, though.

Sony has raised the price in key worldwide regions like Japan, China, Europe, the UK, Mexico, and Canada due to an inflation-heavy market.

What's most interesting about this development is that Sony is no longer willing to absorb losses from its PlayStation hardware sales, and that Sony doesn't really have much of a safety net if the bad press slowly erodes PS5 sales the way it did the Xbox One.

Microsoft took a substantial hit during the Xbox One generation with the console's original $499 MSRP--so much so that the new CEO at the time, Satya Nadella, had asked why Microsoft was in the gaming business at all.

Xbox is now an ecosystem of services, digital games, and products that extend beyond the console market.

Read Also: Why Xbox LIVE is the center of Xbox, not consoles

It turns out Microsoft had a plan for the Xbox One. The all-in-one system was eventually going to be an extension of Windows that connects to a big service framework.

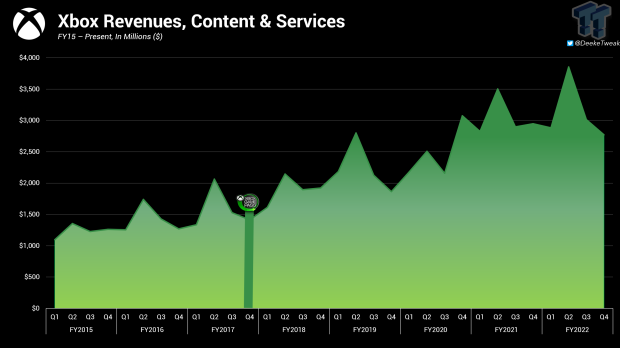

Game Pass has accelerated Xbox revenues with consistent year-over-year growth.

Read Also: Game Pass defines entire Xbox generation, drives year-by-year revenues

They continued with their plan, which saw Xbox transform from a console into a platform. Microsoft joined Xbox One consoles with PC using Windows 10 and created a cross-platform ecosystem. Then in 2017, they rolled out Game Pass, one of the most transformative value-oriented subscription services that ultimately "saved" the Xbox brand as a whole.

Microsoft no longer had to worry about hardware sales. Xbox earnings were on the rise thanks to services and game sales across a combination of platforms. Game Pass sparked earnings growth, eventually earning Microsoft a record $16 billion in FY21.

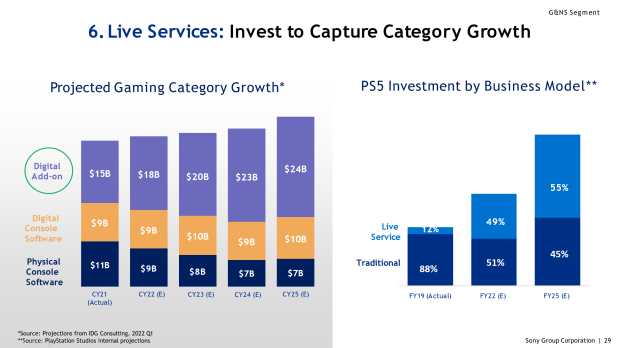

Sony will more heavily invest into risky markets like live services and mobile in an attempt to capture the billion-dollar market that has propped the PlayStation brand up for many years.

The big difference is that Sony doesn't have this kind of integrated plan in place, at least in the same way that unifies console and PC in such a tightly-knit way.

Make no mistake: Sony does have a plan, but it's a risk-heavy strategy that relies on expansion in mobile games and live services. These segments are the largest breadwinners in the games industry and can deliver the most returns, but there's no guarantee of success.

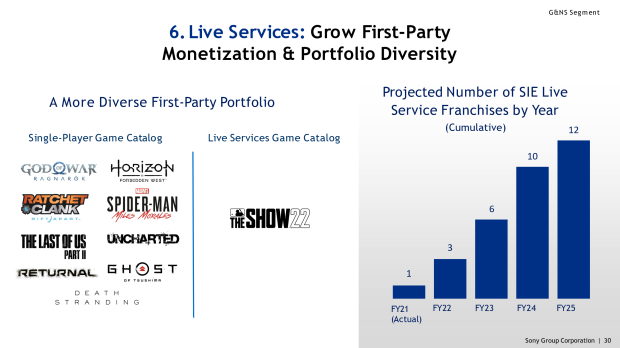

Mobile and live services are the most competitive spaces on the market and are extremely volatile; Sony is making a considerable investment in these segments and wants to have 12 live games on the market by 2025 accompanied by various mobile games.

Sony's new push into live services and free-to-play motivated its acquisition of Bungie for $3.7 billion. As part of Sony Interactive Entertainment, Bungie will be instrumental in helping create and maintain live service games.

Sony's PlayStation 4 platform remains a strong earner that could be monetized for a few more years, but Sony is pushing PS5 console sales as the industry moves forward.

The main fallback that Sony has is the PS4 era. With 117 million consoles shipped to date, the PS4 platform is a mega-earning, robust platform capable of generating tens of billions of dollars a year. The PS4 is long in the tooth, though, and some games are skipping the aging platform altogether.

Case in point: Final Fantasy XVI, which is a PlayStation 5 console exclusive, won't be on the old platform. Gamers are faced with two choices if they want to play: Buy a PS5 at higher prices, or buy a PC. This problem will continue as the industry moves on to Gen 9.

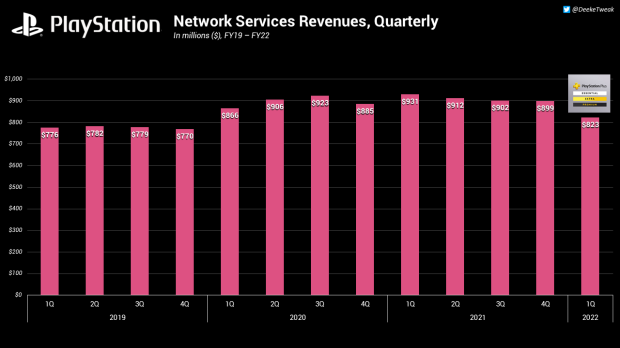

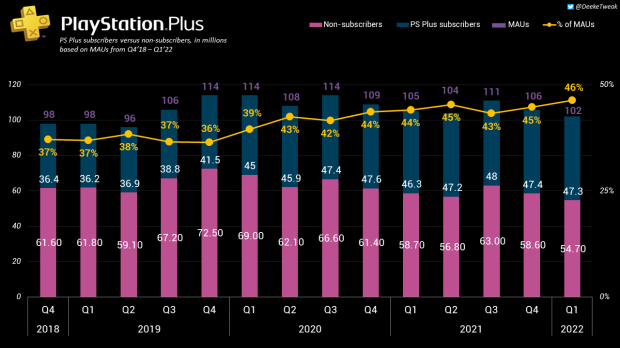

Sony's network services makes billions every year, accounting for over 15% of total revenues (left); PlayStation Plus subscribers vs monthly active users (right).

Services are another big safety net for Sony's PlayStation division. Sony makes billions every year from its Network Services segment, which includes its subscriptions; services pulled in $3.644 billion in FY21, for example.

Sony recently merged PlayStation Now with PlayStation Plus in an effort to add more value. The company delivers three pricing tiers (some of which are quite high, and when compared to Game Pass, don't offer the same day one release guarantee that has made Microsoft's service so popular).

It's worth noting that most PlayStation users do not subscribe to PS Plus and that Sony has yet to publish official adoption figures for its new three-tier PS Plus rollout.

Read Also: PlayStation PC ports to generate $300 million this year

Sony also has PC to fall back on. But this isn't enough. It's true that Sony wants to make $300 million from PC this fiscal year, but that is just a drop in the bucket compared to total PlayStation Network revenues. Sony makes $7.59 billion from add-on content alone, which is far and away the biggest driver for its yearly earnings.

Read Also: Following PS5 price hike, Sony is going all-in on gaming shows & films

Furthermore, Sony is also investing significantly into making TV shows and films on PlayStation properties. The focus has widened beyond games in such a substantial way; Sony has 11 projects based on its IPs in the works, and nine of them are known.

PlayStation Productions TV shows and film adaptations

- Days Gone - Film

- Gravity Rush - Film

- The Last Of Us - HBO Max TV show

- Ghost of Tsushima - Film

- Twisted Metal - Peacock TV Show

- Horizon Zero Dawn - Netflix

- God of War - Prime Video

- Gran Turismo - Film

- Ghost of Tsushima - Film

While Sony is doing well now and shows no signs of being hit with significant losses in the near or even mid-term future (Sony can literally just coast on revenues generated from third-party games for many years in a row and does not have to release first-party heavy-hitters in order to make billions a year), we have to wonder how this will affect Sony in the long term. Will the company be able to juggle all of these spinning plates while taking the big risks of live and mobile games?

Only time will tell. But for now, Sony remains at the top of the games platform market with a mighty billion-dollar digital empire. The only issue is for that empire to expand they will need to ship more PlayStation 5's, which are the only guaranteed platform for revenue earnings over time.