Like pretty much every games company, EA is benefiting tremendously from COVID-19 lockdowns, and their recent Q1'21 earnings reflect strong spikes in overall earnings.

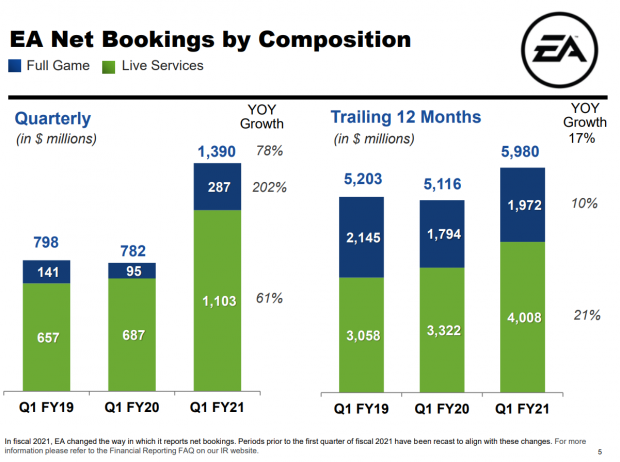

Today EA reported record first-quarter results for Fiscal Year Q1'21 that far exceeded the company's expectations. In the quarter ended March 31, 2020, EA generated $1.459 billion in total revenues, up 21% from last year. Net bookings were up tremendously by 78% YoY to $1.390 billion, outperforming EA's forecast by $390 million, driven by astronomical growth in full game sales and live service monetization. Free cash flow is up 286% to $340 million on these strong results.

Full game sales are up triple digit percentage points to $287 million (+202% YoY), which were driven in part by EA's fusillade of re-releases on Steam and strong console purchases. This reflects increased consumer purchases during COVID-19 quarantines. Q1 is typically EA's slowest period for game sales.

Monetization and live services likewise saw a spike by 61% YoY to $1.103 billion. Live services made up nearly 80% of total net bookings and nearly 75% of total quarter revenues.

EA FYQ1'21 earnings at a glance

- Net revenues - $1.459 billion, +21% YoY

- Operating Income - $471 million, +13.5% YoY

- Net Income - $468 million, down 74% from Q1'20's massive $1.4 billion (thanks to a $985 million tax benefit)

- Net bookings -$1.309 billion, +74% YoY

- Live services - $1.103 billion, +61% YoY

- Full game sales - $287 million, +202% YoY

Game Performance metrics

- Origin earnings up 75% YoY

- FIFA/Madden Ultimate Team earnings up double-digits YoY

- Ultimate team is up 70% for a like-for-like basis

- FIFA attracted 7 million new players in Q1'21, more people are playing more now than any other time in history

- Apex Legends' latest update had the most engaging event ever, biggest event since launch

- Q1 net bookings for Sims was more than double year-over-year

- Star Wars Galaxies has generated more than $1 billion in lifetime revenue

- 52% of sales were digital

- 48% physical

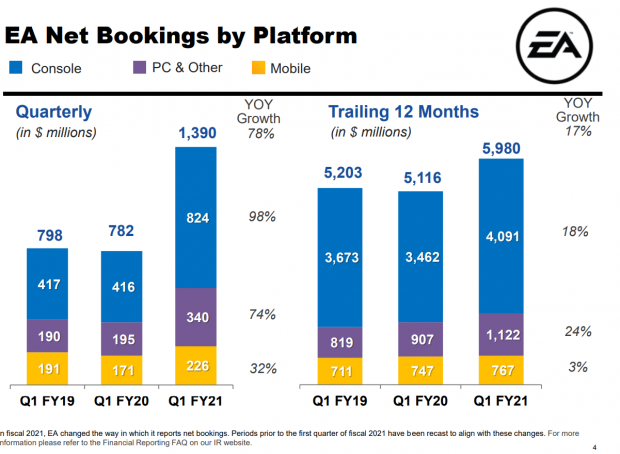

Console earnings rose the most during Q1. In the period, EA's console net bookings earnings skyrocketed by 98% YoY to $824 million.

PC earnings were also up by 74% to $340 million thanks to Steam re-releases. Mobile likewise saw double-digit spikes to $226 million (+34%).

Insofar as performance metrics, EA spent $988 on cost of goods and operating expenses during the period, leaving operating income at $471 million and total net income at $365 million after a $103 provision for income taxes. Total net income for Q1'21 is down 74% due to Q1'20's massive $985 million tax benefit from deferred income taxes, which boosted total net income for the period to $1.421 billion.

FY21 Guidance

Guidance for FYQ2'21 sees a decline in overall revenues. EA expects to make $1.125 billion in net revenue in Q2' down 22% from Q1's strong earnings. Operating expenses are expect to jump by $55 million, and the tax benefits EA enjoyed will wear off in Q2, which will lower net income to $61 million.

For the total Fiscal Year 2021, which includes a number of high-profile AAA games, EA expects to make $869 million in net income on $5.6 billion in revenues. This is an increase of over $400 million, and EA's CFO Blake Jorgensen says the company has only ever raised guidance after Q1 a single time in the company's history.