Cryptocurrency & Mining News - Page 1

Sam Bankman-Fried signs deal to roll on all celebrities that shilled FTX

A group of FTX investors agreed to drop charges against the disgraced FTX founder Sam Bankman-Fried (SBF) in exchange for his devout cooperation in gathering information on celebrities who took money from FTX to endorse the company.

SBF's cooperation will reduce his civil liabilities, which are plenty, and come after his 25-year prison sentence, where he was found guilty on seven counts of fraud, embezzlement, and criminal conspiracy. Now, FTX investors are looking for as much information as SBF can provide on the seemingly long list of celebrities who took money from FTX to promote the brand. Celebrities such as Tom Brady, Larry David, Steph Curry, Shaquille O'Neal, and supermodel Gisele Bundchen immediately come to mind, but there are undoubtedly others that have been initially forgotten.

Notably, SBF isn't the only one that is rolling on celebrities as other former FTX officials like Nishad Singh, Gary Wang, and Caroline Ellison, former girlfriend of SBF, have also all agreed to cooperate with prosecutors and provide any information they can, which they reportedly already have begun to.

BioMatrix introduces PoY, the world's first UBI token with 60 years Issuance Commitment

Entering the digital future, I have had the chance to explore BioMatrix's cutting-edge blockchain platform. As a technology enthusiast, the idea of the Proof of You (PoY) token caught my attention at first, especially with its pledge to "distribute wealth in a fair and equitable manner."

The selling point of the PoY token is that it is not just a digital asset, but it is an integral part of the company's Universal Basic Income (UBI) distribution strategy, which is designed to connect the user's biological identity to blockchain technology - an important development that could help bridge financial divides around the world.

At its recent launch in Dubai, the BioMatrix platform showcased its potential to redefine the UBI landscape. Like many other secure platforms, BioMatrix is built with user empowerment in mind, and leverages advanced AI and blockchain technology to facilitate its ecosystem growth and expansion. However, the key difference that sets BioMatrix apart from other UBI platforms is using newer cryptography solutions like Zero-Knowledge Proofs (ZKP) to protect user privacy and security.

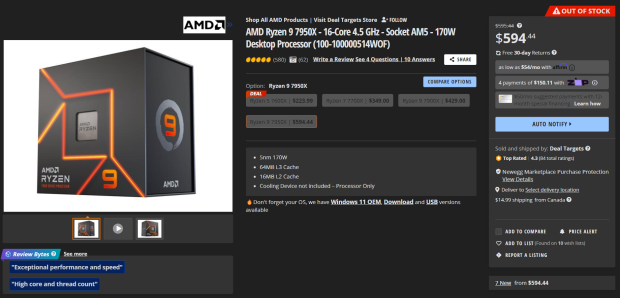

AMD Ryzen 9 7950X used by cryptominers, making $3 per day in profit from their CPUs

Uh-oh... it's starting again... AMD's current-gen Ryzen 9 7950X processor has become a super-popular CPU for crypto mining, earning higher profits than some of the fastest GPUs on the market.

Our friends at Wccftech are reporting that because of the rise of Bitcoin pricing, CPUs are being used for crypto mining, whereas Qubic (QBIC), crypto miners are using CPUs that have AVX2 and AVX512 instructions on the Zen 4 architecture, which are great for crypto mining. Intel dropped AVX512 support for its processors, starting with Alder Lake, seeing crypto miners flocking to Ryzen 7000 series processors.

AMD processors were used for Raptoreum mining algorithms, using the huge L3 cache on Ryzen and Threadripper CPUs. 3D V-Cache models featured gigantic pools of cache stacked on the chips, perfect for crypto mining. Qubic (QBIC) coins generate a profit of around $3 per 24 hours, including the electricity cost of running a Ryzen 9 7950X processor, even at 170W of power consumption.

Bitcoin reaches new all-time high before quickly tumbling back down

After years of waiting, the price of Bitcoin hit a new all-time high, pushing just above $70,000 before it quickly recorrected by 5%.

It was November 2021 when Bitcoin hit its previous all-time high, capping out at $69,000 before the world's most valuable cryptocurrency entered into a bear market of price recorrection. That bear market has seemingly come to its end as the price of BTC has been on the rise since November 2022, steadily increasing all throughout 2023 and now reaching its new all-time high of $70,184.

CNBC reports the upswing in price began when the US stock market opened, which can be traced back to the introduction of spot bitcoin exchange-traded funds in the US. On Tuesday, BTC pushed to its previous highs, and once it got there, the cryptocurrency quickly tumbled back down by as much as 10%, which resulted in many other cryptocurrency coins coming down with it. However, those losses were then regained the next day, eventually leading to the new all-time high.

Continue reading: Bitcoin reaches new all-time high before quickly tumbling back down (full post)

PlayStation 5 APU used in AMD BC-250 crypto mining cards, that are now on eBay for $500

Well, we're seeing some interesting use of the PlayStation 5 APU... in the form of the AMD BC-250 crypto mining card that has just hit eBay. Check them out:

ASRock has a crazy mining system that cost $15,000 when it was released, packing 12 x AMD BC-250 crypto mining cards in a kitted-out mining chassis. Each of the BC-250 crypto mining cards features the Ariel/Oberon processors that have Zen 2 CPUs and RDNA 2 GPUs, which make up the APU or SoC inside of Sony's current-gen PlayStation 5 console.

However, these BC-250 chips are not fully functioning, as they have partially disabled graphics that were also retro-fitted into the AMD 4700S desktop kit. At the time, the ASRock 12 x GPU mining system was pumping away at 610MH/s on both ETHASH and ETC. That wasn't bad at the time, with $2 per day per GPU.

Binance guilty of money laundering, agrees to pay $4.3 billion fine, CEO also resigns

Binance is in a world of trouble right now, with Binance founder Changpeng Zhao pleading guilty to money laundering and agreeing to resign from the company.

Not only that, but Zhao will pay a $50 million fine and will be barred from any involvement in the Binance business. As for Binance, the company pleaded guilty, accenting the appointment of a monitor and a criminal fine of close to $1.81 billion, and a $2.51 billion order of forfeiture to settle not one but three criminal charges.

The US Justice Department charged Binance, which is the world's largest cryptocurrency exchange, with conducting an unlicensed money transmitting business, a conspiracy charge, and violating the International Emergency Economic Powers Act.

Secret crypto mining rig found under Polish court floor, was run by IT maintenance staff

The IT maintenance staff working in the Supreme Administrative Court of Warsaw, Poland, were busted with a hidden cryptocurrency mining operation underneath the Supreme Court.

Crypto mining hardware was found inside of the ventilation duct, and the technical floor was discovered in the last couple of months, with the investigation being conducted by the prosecutor's office, while the Internal Security Agency has been notified of the crypto mining operation being busted.

Investigators found computers and components placed inside of the technical floor near the devices supplying power to the building, so the crypto mining operators were sucking down power from the court while making moola on the side. The cryptocurrency mining operation under the Supreme Court in Poland might have been using their power. Still, they had their own networking hardware and modem, meaning they had their own internet connection to the mining rigs, too.

YouTuber gets $60,000 worth of crypto stolen from him during a livestream

A blockchain and cryptocurrency YouTuber was livestreaming when he accidentally revealed vital information for several of his crypto wallets.

That YouTuber is Ivan Bianco, who runs the channel Fraternidade Crypto, a cryptocurrency-gaming focussed channel based out of Brazil. Bianco was livestreaming when he accidentally revealed some of his seed phrases for his wallets. If you aren't familiar with the crypto nomenclature, seed phrases are basically complex passwords that grant access to wallets containing coins.

Bianco opened a document during his livestream that revealed several seed phrases, which viewers then recorded down and then later accessed, stealing $60,000 worth of coins and NFTs. The theft reportedly occurred within minutes of the seed phrases being revealed, and the YouTuber was seen during a later livestream crying and explaining to his viewers what had happened.

SEC fines US media company millions for selling unregistered NFTs

The US Securities and Exchange Commission (SEC) has settled its first-ever enforcement action against a company that was selling unregistered Non-Fungible Tokens (NFTs).

That company is Impact Theory, and according to a recent filing with the Securities and Exchange Commission, the company has been ordered to pay more than $6.1 million in penalties. Impact Theory, the Los Angeles-based media company, raised approximately $30 million from hundreds of investors for its NFT project "Founder's Key".

According to the SEC, Impact Theory wrongfully encouraged investors to purchase the NFTs as a way to invest in the business, and since the company offered investors digital assets through a form of "investment contracts", the NFTs are considered to be "securities". Additionally, the SEC order instructed the company to create a "Fair Fund", which is meant to be a way investors can recover their losses.

Continue reading: SEC fines US media company millions for selling unregistered NFTs (full post)

Bored Ape investors sue Paris Hilton and Justin Bieber over undisclosed financial ties

The once-popular Non-Fungible Token (NFT) collection Bored Apes has dramatically decreased in value since the collapse of the price of Bitcoin, resulting in fear-uncertainty, and doubt to plague the cryptocurrency space.

Following the dramatic price dip of Bored Apes, which were only highly sought-after NFTs, a group of Bored Ape investors have filed a lawsuit against Sotheby's auction house for a 2021 promotion of a Bored Ape collection. According to the four plaintiffs, the auction house "misleadingly promoted" the NFT collection and colluded with Bored Ape Yacht House creators Yuga Labs in an effort to artificially increase the price of the NFTs.

Sotheby's isn't the only one named in the lawsuit, as the group of investors has also named celebrities such as Justin Bieber and Paris Hilton, which are both accused of promoting the NFT collection without disclosing financial ties to Yuga Labs. For context on how much the price of Bored Apes has dropped, the cheapest of the colorful NFTs was sold back in May 2022 for $400,000, and now the cheapest Bored Ape can be bought for just $52,445.