Performance-based compensation is one part of how Take-Two rewards its executives, and most of those awards are based around stock prices, not microtransactions.

A bit ago Axios published a report outlining specific terms of Take-Two CEO Strauss Zelnick's pay structure. One interesting tidbit was how Zelnick and other executives like president Karl Slatoff are rewarded specifically if Recurrent Consumer Spending (RCS) grows.

Here's the company's official definition of RCS: "Recurrent Consumer Spending may generally include, without limitation, the sale of virtual currency, add-on content, microtransactions, NFTs, game related subscriptions offered directly by the Company and/or its subsidiaries and similar items but would not include full-game digital downloads."

A quick note: Zelnick and Karl Slatoff actually advise Take-Two as part of Zelnick Media. Take-Two delivers four different kinds of awards and fees to Zelnick Media:

• Management fee - $22.5 million (thru 2029)

• Annual bonus

• RSU rewards: Includes Time-based awards and Performance-based awards

A recent SEC report notes that Recurrent Consumer Spending is actually 25% of the Performance-based RSU rewards. The other 75% is determined whether or not stock rises, and by how much.

In short, Strauss Zelnick and other employees of Zelnick Media are rewarded more for stock price increases and less for Recurrent Consumer Spending.

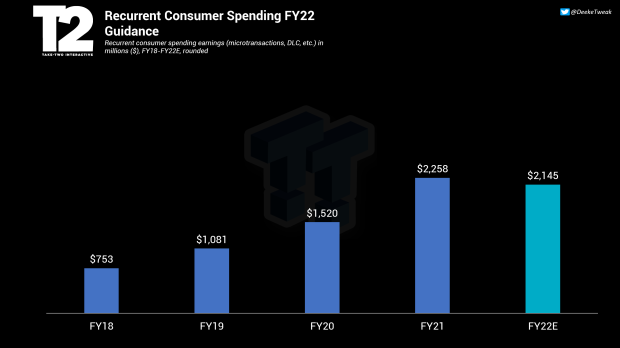

The stipulations can be tough. If total RCS growth is less than 3%, the microtransaction-based bonus is $0. For reference, Take-Two expects its FY2022 microtransaction revenues to slide by 5% year-over-year.

It's also worth mentioning that Strauss Zelnick cannot receive more than 60% of total compensation throughout any period. This includes management fees, time- and performance-based RSUs, and annual bonuses.

Management Fee and Annual Bonus Opportunity

"Commencing as of the Effective Date, the Company will pay ZelnickMedia a monthly management fee equal to $275,000 per month in each year during the term of the Management Agreement."

- The management agreement lasts from now until 2029

- $3.3 million a year

- Management fee - $22.5 million total from 2022 - 2029

Annual Bonus

Annual Bonus - Target bonus 200% of the Management Fee, or $6,600,000 per annum

The term "Target" shall mean budgeted adjusted EBITDA of the Company (or other measurement of financial, ESG or other similar performance criteria reasonably determined by the members of the Board

Restricted Stock Unit (RSUs) Awards

Time-based awards

The Company will make three separate grants of time-based restricted stock units to ZelnickMedia equal to the number as is determined by dividing $4,618,519, $5,055,556, and $6,866,667, respectively, by the price per share of the Company's common stock used for the Company's fiscal 2023 annual restricted stock unit grant to the Company's officers and employees (the "Reference Price").

Performance-based awards

The Company will make three separate grants of performance-based restricted stock units to ZelnickMedia (the "Performance Awards") equal to the number as is determined by dividing $9,237,037, $10,111,111 and $13,733,333, respectively, by the Reference Price, which units represent the target number of performance-based restricted stock units that are eligible to vest (with the maximum number of performance-based restricted stock units being equal to 200% of the target amount).

Each Performance Award will be divided into two categories of vesting as follows:

(i) 25% of the restricted stock unit award will be based on an operational performance metric relating to recurrent consumer spending during the applicable performance period and will vest in June 2024 with respect to the first grant and in June 2025 with respect to the second and third grants and

(ii) 75% of the restricted stock unit award will be based on the performance of the Company's stock price relative to the Nasdaq-100 index during the applicable performance period and will vest in June 2024 with respect to the first grant and in June 2025 with respect to the second and third grants.

Recurrent Consumer Spending may generally include, without limitation, the sale of virtual currency, add-on content, microtransactions, NFTs, game related subscriptions offered directly by the Company and/or its subsidiaries and similar items, but would not include full-game digital downloads.