GameStop is slowly transforming towards being a profitable company and has made significant reductions in losses and debt in 2021.

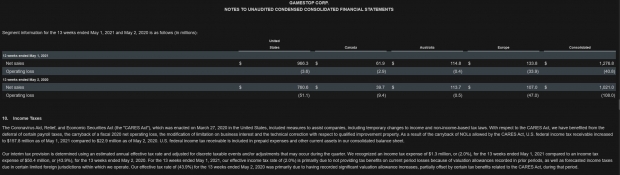

GameStop ($GME) just announced its earnings for the 13-week period ending May 1, 2021, and the results show significant progress towards profitability. The company has reduced its debt by 91% and its net losses by 59%.

As of May 2021, GameStop owes $48.1 million in total short- and long-term debts, down 91% year-over-year. GameStop owed a whopping $552 million in debt in May 2020. The current debt is part of the company's French term loans, which GameStop says can be extended and adjusted over time. The retailer was able to wipe out its long-term debts with a successful 3.5 million share offering. GameStop earned $551.7 million from the stock issue and it used that money to pay back over $330 million in borrowings and senior debt notes.

Net losses are also down significantly. In the period, GameStop's operating losses were $66.8 million, down 59% from $165.7 million from a year ago.

GameStop's net losses were stabilized by government aid. The company benefited from tax breaks in the CARES act, which allowed it to increase its tax receivables to $157.8 million compared to $22.9 million in 2020. GameStop was able to do a carryback of net operating losses for the past five years and receive a hefty refund while also deferring certain payroll taxes.

The tax break helped GameStop reduce its 2021 operating losses by 62% to $40.8 million compared to $108 million in 2020.

As a result of the share offering proceeds and the reduction of losses and debt, GameStop currently has $770.8 million in cash and cash equivalents on hand.

The retailer still has big ambitions to transform into an e-commerce giant and embrace a hybridized business model focused on retail brick-and-mortar stores and with Amazon-like online shopping/delivery services.