Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its fourth fiscal quarter ended March 31, 2015.

"With a clear focus on putting our players first, FY15 was an exceptional year for Electronic Arts. We introduced award-winning games, delivered enduring entertainment in our live services, and forged deeper relationships with a growing global audience across consoles, mobile devices and PC," said Chief Executive Officer Andrew Wilson. "EA continues to sharpen our focus and speed, and in the year ahead we will engage more players on more platforms with new experiences like Star Wars Battlefront, FIFA 16, Minions Paradise and more."

"Two years ago, we discussed a three-year plan to double non-GAAP operating margins to 20%," said Chief Financial Officer Blake Jorgensen. "Today, I'm happy to announce that we exceeded our goal a full year ahead of schedule. Looking forward, we anticipate continued earnings growth driven by our strong portfolio, investment in new IP, the market shift to digital, and on-going cost discipline."

News and ongoing updates regarding EA and our games are available on EA's blog at www.ea.com/news.

Selected Operating Highlights and Metrics:

- For fiscal year 2015 EA was the #1 publisher on PlayStation®4 and Xbox One consoles in the world, driven by the success of BattlefieldHardline, Dragon Age: Inquisition, FIFA 15, NHL®15, Madden NFL 15, Battlefield 4 and FIFA 14.

- More than 30 million game sessions of Battlefield Hardline were played in Q4.

- Nearly 200 million hours of Dragon Age: Inquisition have been played life-to-date.

- The Simpsons: Tapped Out averaged more than 16 million monthly players throughout FY15.

- Monthly active users for EA's mobile titles averaged more than 165 million in Q4.

- Players can live out their Star Wars fantasies when Star Wars�Battlefront� launches beginning on November 17, 2015 on PlayStation 4, Xbox One and on Origin for PC.

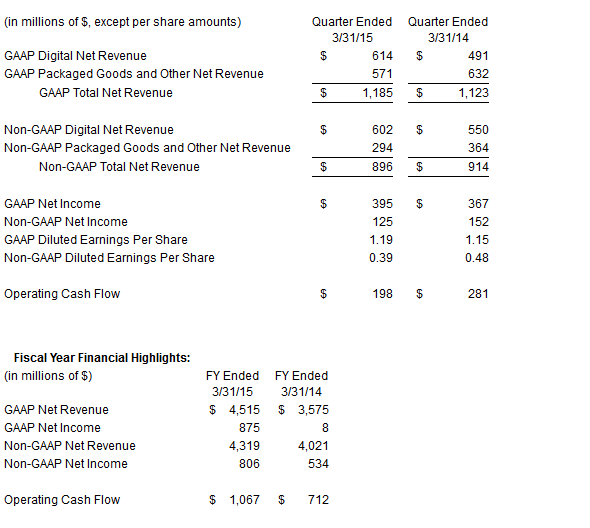

Selected Financial Highlights:

*On a non-GAAP basis

- For the quarter, net revenue* of $896 million was above our guidance of $830 million. Diluted earnings per share* of $0.39 was above our guidance of $0.22.

- For fiscal year 2015, EA had net revenue* of $4.319 billion of which a record $2.230 billion was digital*, net income* of $806 million and operating cash flow of $1.067 billion, a record for any fiscal year.

- EA provided fiscal 2016 net revenue* guidance of $4.400 billion and diluted EPS* guidance of $2.75 per share. Net revenue* guidance assumes a negative $250 million impact due to the year over year change in foreign exchange rates.

- EA repurchased 1.8 million shares in Q4 for $95 million.

- Mobile revenue* set a new EA record, contributing $524 million for the fiscal year.

Stock Repurchase Program

EA has announced that its Board of Directors has authorized a new program to repurchase up to $1 billion of EA's common stock. This new stock repurchase program, which expires on May 31, 2017, supersedes and replaces the existing stock repurchase authorization approved by a special committee of EA's Board of Directors in May 2014.

Under the program, EA may purchase stock in the open market or through privately negotiated transactions in accordance with applicable securities laws, including pursuant to pre-arranged stock trading plans. The timing and actual amount of the stock repurchases will depend on several factors including price, capital availability, regulatory requirements, alternative investment opportunities and other market conditions. EA is not obligated to repurchase any specific number of shares under the program and the repurchase program may be modified, suspended or discontinued at any time.

Business Outlook as of May 5, 2015

The following forward-looking statements, as well as those made above, reflect expectations as of May 5, 2015. Electronic Arts assumes no obligation to update these statements. Results may be materially different and are affected by many factors detailed in this release and in EA's annual and quarterly SEC filings.

Fiscal Year 2016 Expectations - Ending March 31, 2016

- GAAP net revenue is expected to be approximately $4.250 billion.

- Non-GAAP net revenue is expected to be approximately $4.400 billion.

- GAAP diluted earnings per share is expected to be approximately $1.90.

- Non-GAAP diluted earnings per share is expected to be approximately $2.75.

- The Company estimates a share count of 340 million for purposes of calculating fiscal year 2016 GAAP diluted earnings per share and 331 million for purposes of calculating fiscal year 2016 non-GAAP diluted earnings per share. Non-GAAP shares used for computing diluted earnings per share differs from GAAP due to the inclusion of the anti-dilutive effect of the Convertible Bond Hedge.

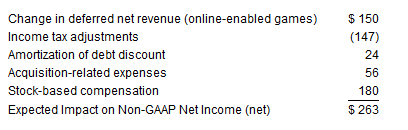

- Expected non-GAAP net income excludes the impact of the following items (estimate in millions) from expected GAAP net income:

First Quarter Fiscal Year 2016 Expectations - Ending June 30, 2015

- GAAP net revenue is expected to be approximately $1.140 billion.

- Non-GAAP net revenue is expected to be approximately $640 million.

- GAAP diluted earnings per share is expected to be approximately $1.14.

- Non-GAAP diluted earnings per share is expected to be approximately $0.00.

- The Company estimates a share count of 337 million for purposes of calculating first quarter fiscal year 2016 GAAP diluted earnings per share, and 328 million for non-GAAP diluted earnings per share and 312 million for non-GAAP loss per share. Non-GAAP shares used for computing diluted earnings per share differs from GAAP due to the inclusion of the anti-dilutive effect of the Convertible Bond Hedge.

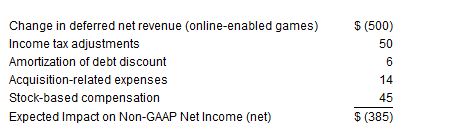

- Expected non-GAAP net income excludes the impact of the following items (estimate in millions) from expected GAAP net income:

Conference Call and Supporting Documents

Electronic Arts will host a conference call on May 5, 2015 at 2:00 pm PT (5:00 pm ET) to review its results for the fourth quarter ended March 31, 2015 and its outlook for the future. During the course of the call, Electronic Arts may disclose material developments affecting its business and/or financial performance. Listeners may access the conference call live through the following dial-in number: 888-469-0955 (domestic) or 312-470-7475 (international), using the password "EA" or via webcast at http://ir.ea.com.

EA will also post a slide presentation that accompanies the call at http://ir.ea.com.

A dial-in replay of the conference call will be provided until May 19, 2015 at 888-566-0094 (domestic) or 203-369-3399 (international). An audio webcast replay of the conference call will be available for one year at http://ir.ea.com.

Non-GAAP Financial Measures

To supplement the Company's unaudited condensed consolidated financial statements presented in accordance with GAAP, Electronic Arts uses certain non-GAAP measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company's results of operations as determined in accordance with GAAP. The non-GAAP financial measures used by Electronic Arts include: non-GAAP net revenue, non-GAAP gross profit, non-GAAP operating income (loss), non-GAAP net income (loss), non-GAAP diluted earnings (loss) per share and non-GAAP diluted shares. These non-GAAP financial measures exclude the following items (other than Shares from Convertible Bond Hedge, which are included), as applicable in a given reporting period, from the Company's unaudited condensed consolidated statements of operations:

- Acquisition-related expenses

- Amortization of debt discount

- Change in deferred net revenue (online-enabled games)

- College football settlement expenses

- Income tax adjustments

- Loss on licensed intellectual property commitment (COGS)

- Restructuring charges

- Shares from Convertible Bond Hedge

- Stock-based compensation

Electronic Arts may consider whether other significant non-recurring items that arise in the future should also be excluded in calculating the non-GAAP financial measures it uses.

Electronic Arts believes that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding the Company's performance by excluding certain items that may not be indicative of the Company's core business, operating results or future outlook. Electronic Arts' management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing the Company's operating results both as a consolidated entity and at the business unit level, as well as when planning, forecasting and analyzing future periods. The Company's management team is evaluated on the basis of non-GAAP financial measures and these measures also facilitate comparisons of the Company's performance to prior periods.

In addition to the reasons stated above, which are generally applicable to each of the items Electronic Arts excludes from its non-GAAP financial measures, the Company believes it is appropriate to exclude certain items for the following reasons:

Acquisition-Related Expenses. GAAP requires expenses to be recognized for various types of events associated with a business acquisition. These events include, expensing acquired intangible assets, including acquired in-process technology, post-closing adjustments associated with changes in the estimated amount of contingent consideration to be paid in an acquisition, and the impairment of accounting goodwill created as a result of an acquisition when future events indicate there has been a decline in its value. When analyzing the operating performance of an acquired entity, Electronic Arts' management focuses on the total return provided by the investment (i.e., operating profit generated from the acquired entity as compared to the purchase price paid including the final amounts paid for contingent consideration) without taking into consideration any allocations made for accounting purposes. When analyzing the operating performance of an acquisition in subsequent periods, the Company's management excludes the GAAP impact of any adjustments to the fair value of these acquisition-related balances to its financial results.

Amortization of Debt Discount on the Convertible Senior Notes. Under GAAP, certain convertible debt instruments that may be settled in cash on conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer's non-convertible debt borrowing rate. Accordingly, for GAAP purposes, we are required to amortize as a debt discount an amount equal to the fair value of the conversion option as interest expense on the Company's $632.5 million of 0.75% convertible senior notes that were issued in a private placement in July 2011 over the term of the notes. Electronic Arts' management excludes the effect of this amortization in its non-GAAP financial measures.

Change in Deferred Net Revenue (Online-enabled Games). The majority of our software games can be connected to the Internet whereby a consumer may be able to download unspecified content or updates on a when-and-if-available basis ("unspecified updates") for use with the original game software. In addition, we may also offer an online matchmaking service that permits consumers to play against each other via the Internet. GAAP requires us to account for the consumer's right to receive unspecified updates or the matchmaking service for no additional fee as a "bundled" sale, or multiple-element arrangement. Electronic Arts is not able to objectively determine the fair value of these unspecified updates or online service included in certain of its online-enabled games. As a result, the Company recognizes the revenue from the sale of these online-enabled games on a straight-line basis over the estimated offering period. Electronic Arts' management excludes the impact of the change in deferred net revenue related to online-enabled games in its non-GAAP financial measures for the reasons stated above and also to facilitate an understanding of our operations because all related costs of revenue are expensed as incurred instead of deferred and recognized ratably.

College Football Settlement Expenses. During fiscal 2014, Electronic Arts recognized a $48 million charge for expected litigation settlement and license expenses related to our college football business. This expense is excluded from our non-GAAP financial measures.

Income Tax Adjustments. The Company uses a fixed, long-term projected tax rate internally to evaluate its operating performance, to forecast, plan and analyze future periods, and to assess the performance of its management team. Prior to April 1, 2013, a 28 percent tax rate was applied, and from April 1, 2013 until March 31, 2015, a 25 percent tax rate was applied to its non-GAAP financial results. Based on a re-evaluation of its fixed, long-term projected tax rate, beginning in fiscal year 2016, the Company will apply a tax rate of 22 percent to its non-GAAP financial results.

Loss on Licensed Intellectual Property Commitment. During the first quarter of fiscal 2015, Electronic Arts terminated its right to utilize certain intellectual property that the Company had previously licensed and we incurred a loss of $122 million on the corresponding license commitment. This expense is excluded from our non-GAAP financial measures.

Restructuring Charges. Although Electronic Arts has engaged in various restructuring activities in the past, each has been a discrete event based on a unique set of business objectives. Each of these restructurings has been unlike its predecessors in terms of its operational implementation, business impact and scope. As such, the Company believes it is appropriate to exclude restructuring charges from its non-GAAP financial measures.

Shares from Convertible Bond Hedge. In July 2011, the Company issued convertible senior notes that mature in July 2016 (the "Notes") with an initial conversion price of approximately $31.74 per share. When the quarterly average trading price of EA's common stock is above $31.74 per share, the potential conversion of the Notes has a dilutive impact on the Company's earnings per share. At the time the Notes were issued, the Company entered into convertible note hedge transactions (the "Convertible Bond Hedge") to offset the dilutive effect of the Notes. The Company includes the anti-dilutive effect of the Convertible Bond Hedge in determining its non-GAAP dilutive shares.

Stock-Based Compensation. When evaluating the performance of its individual business units, the Company does not consider stock-based compensation charges. Likewise, the Company's management teams exclude stock-based compensation expense from their short and long-term operating plans. In contrast, the Company's management teams are held accountable for cash-based compensation and such amounts are included in their operating plans. Further, when considering the impact of equity award grants, Electronic Arts places a greater emphasis on overall shareholder dilution rather than the accounting charges associated with such grants.

In the financial tables below, Electronic Arts has provided a reconciliation of the most comparable GAAP financial measures to non-GAAP financial measures used in this press release.

Forward-Looking Statements

Some statements set forth in this release, including the information relating to EA's fiscal 2016 guidance information under the heading "Business Outlook," contain forward-looking statements that are subject to change. Statements including words such as "anticipate," "believe," "estimate" or "expect" and statements in the future tense are forward-looking statements. These forward-looking statements are preliminary estimates and expectations based on current information and are subject to business and economic risks and uncertainties that could cause actual events or actual future results to differ materially from the expectations set forth in the forward-looking statements.

Some of the factors which could cause the Company's results to differ materially from its expectations include the following: sales of the Company's titles; the Company's ability to manage expenses; the competition in the interactive entertainment industry; the effectiveness of the Company's sales and marketing programs; timely development and release of Electronic Arts' products; the Company's ability to realize the anticipated benefits of acquisitions; the consumer demand for, and the availability of an adequate supply of console hardware units; the Company's ability to predict consumer preferences among competing platforms; the Company's ability to service and support digital product offerings, including managing online security; general economic conditions; and other factors described in the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2014.

These forward-looking statements are current as of May 5, 2015. Electronic Arts assumes no obligation and does not intend to update these forward-looking statements. In addition, the preliminary financial results set forth in this release are estimates based on information currently available to Electronic Arts.

While Electronic Arts believes these estimates are meaningful, they could differ from the actual amounts that Electronic Arts ultimately reports in its Annual Report on Form 10-K for the fiscal year ended March 31, 2015. Electronic Arts assumes no obligation and does not intend to update these estimates prior to filing its Form 10-K for the fiscal year ended March 31, 2015.

Last updated: Apr 7, 2020 at 12:09 pm CDT

United States: Find other tech and computer products like this over at

United States: Find other tech and computer products like this over at  United Kingdom: Find other tech and computer products like this over at

United Kingdom: Find other tech and computer products like this over at  Australia: Find other tech and computer products like this over at

Australia: Find other tech and computer products like this over at  Canada: Find other tech and computer products like this over at

Canada: Find other tech and computer products like this over at  Deutschland: Finde andere Technik- und Computerprodukte wie dieses auf

Deutschland: Finde andere Technik- und Computerprodukte wie dieses auf