- Revenue of $14.5 billion

- GAAP earnings of $0.42 per share, non-GAAP earnings of $0.50 per share

- Dell Enterprise Solutions and Services revenue grew 6 percent year over year to $4.9 billion; now represents more than 50 percent of company margin and more than a third of revenue

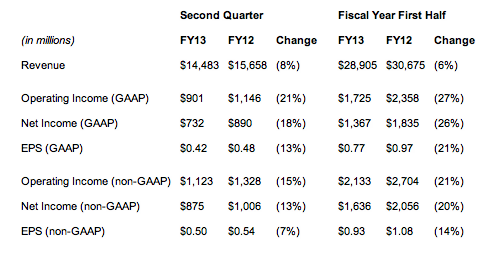

Dell announced fiscal 2013 second-quarter results today with revenue of $14.5 billion, GAAP operating income of $901 million, and earnings of $0.42 per share. Consistent with its strategy, Dell saw growth in its server, services and networking businesses.

"We're transforming our business, not for a quarter or a fiscal year, but to deliver differentiated customer value for the long term," said Michael Dell, chairman and CEO. "We're clear on our strategy and we're building a leading portfolio of solutions to help our customers achieve their goals."

"Our performance in the second quarter provided another proof-point that our long-term strategy is right," said Brian Gladden, Dell chief financial officer. " W e continued our progress in shifting the mix of our business to higher-margin enterprise solutions, led by solid growth in our server, networking, services, and Dell IP storage businesses.

"Growth in our PC business was challenging, as we saw a tough macroeconomic and competitive environment, and continued to focus on higher-value solutions in this business," Mr. Gladden said.

Results

- Revenue in the quarter was $14.5 billion, an 8 percent decrease from the previous year as desktop and mobility revenue contracted.

- GAAP operating income for the quarter was $901 million, or 6.2 percent of revenue. Non-GAAP operating income was $1.1 billion, or 7.8 percent of revenue. Gross margins for the quarter benefitted by approximately $70 million, or 50 basis points, primarily resulting from a vendor settlement.

- GAAP earnings per share in the quarter was 42 cents, down 13 percent from the previous year; non-GAAP EPS was 50 cents, down 7 percent.

- Cash flow from operations in the quarter was $637 million. Dell ended the quarter with $14.6 billion in cash and investments.

Fiscal-Year 2013 Second Quarter and Half Year Highlights

Strategic Highlights:

- Dell Enterprise Solutions and Services revenue grew 6 percent year over year to $4.9 billion and comprised 34 percent of Dell's consolidated revenue and more than 50 percent of its margin. This business is now approaching a $20 billion annual run rate.

- Server and networking revenue grew 14 percent.

- Revenue of Dell-owned storage increased 6 percent.

- Dell Services revenue was $2.1 billion, up 3 percent, with new signings of more than $1 billion in the first half of the year, and $1.8 billion over the last 12 months.

- Year to date Dell has announced six acquisitions and closed five, all of which will help drive a higher-value mix of solutions with more predictable revenue and margin streams. The company expects to close the pending acquisition of Quest Software in the second half of the third quarter.

Business Units and Regions:

- Large Enterprise revenue was $4.5 billion in the quarter, a 3 percent decline. Operating income was $433 million, or 9.5 percent of revenue. Enterprise Solutions and Services revenue increased 9 percent on 17 percent growth in server and networking revenue and 5 percent increase in services.

- Public revenue was $4.1 billion, a 6 percent decrease. O perating income for the quarter was $379 million, or 9.3 percent of revenue. Server and networking revenue increased 4 percent.

- Small and Medium Business revenue was $3.3 billion, a 1 percent decline. Operating income was $382 million, or 11.7 percent of revenue. Enterprise solutions and services grew 15 percent led by an increase of 27 percent in services revenue and 16 percent in servers and networking.

- Consumer revenue was $2.6 billion, a 22 percent decline. Operating income was $14 million or 0.5 percent of revenue.

- Revenue in Americas was down 6 percent; EMEA was down 7 percent, and Asia-Pacific and Japan revenue was down 12 percent. Revenue in BRIC countries was down 15 percent.

Company Outlook:

Dell expects continued solid growth in Enterprise Solutions, Services and Software and also a challenging end-user computer environment in the second half of the year. Given the uncertain economic environment, competitive dynamics and soft Consumer business, Dell expects third-quarter revenue to be down 2-5 percent from second-quarter levels. In addition, the company is modifying its full-year earnings outlook to at least $1.70 per share on a non-GAAP basis, which includes a 2-to-3 cent dilutive impact from its pending acquisition of Quest Software.

Last updated: Apr 7, 2020 at 12:07 pm CDT

United States: Find other tech and computer products like this over at

United States: Find other tech and computer products like this over at  United Kingdom: Find other tech and computer products like this over at

United Kingdom: Find other tech and computer products like this over at  Australia: Find other tech and computer products like this over at

Australia: Find other tech and computer products like this over at  Canada: Find other tech and computer products like this over at

Canada: Find other tech and computer products like this over at  Deutschland: Finde andere Technik- und Computerprodukte wie dieses auf

Deutschland: Finde andere Technik- und Computerprodukte wie dieses auf