Business, Financial & Legal News - Page 80

Donald Trump Jr and AOC agree on one thing: Robinhood is screwed

You know the world is changing when you've got politicians on both sides agreeing on something as large as the huge Robinhood + r/WallStreetBets + GameStop + AMC trade drama -- scandal -- explosion. I don't even know how to describe it anymore.

The previously super-popular trading app Robinhood halted trades -- even SELLING users GME stock without permission -- on the to-the-moon stocks of GameStop, AMC and other companies because of the huge swath of Redditors coming in from r/WallStreetBets and now all over the world. Their bets caused hedge funds to lose billions of dollars, while they made huge profits. It has already led to class action lawsuits.

Well, now we have Donald Trump Jr and Congresswoman Alexandria Ocasio-Cortez weighing in on the GameStop and Robinhood fiasco. AOC tweeted: "Gotta admit it's really something to see Wall Streeters with a long history of treating our economy as a casino complain about a message board of posters also treating the market as a casino".

Continue reading: Donald Trump Jr and AOC agree on one thing: Robinhood is screwed (full post)

Robinhood draws down credit lines with banks over WallStreetBets drama

Well, well, well -- that was faster than I thought.

Robinhood Markets -- the trading app that is in the headlines right now, has reportedly drawn credit lines with banks to the tune of "at least several hundred million dollars" reports one of Bloomberg's sources. Robinhood lenders include companies like JPMorgan Chase & Co. and Goldman Sachs Group Inc.

Bloomberg adds that the "behind-the-scenes rush to bolster Robinhood's finances adds to signs that recent market havoc is putting a strain on the company". Robinhood explained in a blog post on its website today: "As a brokerage firm, we have many financial requirements, including SEC net capital obligations and clearinghouse deposits".

Continue reading: Robinhood draws down credit lines with banks over WallStreetBets drama (full post)

Robinhood app review bombed on Google Play Store after GME insanity

Robinhood has been in the headlines for literally all the wrong reasons, with people beyond pissed off that the trading app halted GameStop trade restrictions -- leading into a class action lawsuit, and now the Robinhood app being review bombed on the Google Play Store.

Users have bombarded the Robinhood app with one-star reviews, forcing the app down into averaging at the lowest rating on the Google Play Store. Users are rightfully angry, as they've seen their ability to buy shares of stocks that are skyrocketing completely banned from use, so over 100,000+ negative reviews for the app isn't a surprise.

There's much more to all of this story below:

Continue reading: Robinhood app review bombed on Google Play Store after GME insanity (full post)

Robinhood hit with class action lawsuit over GME trade restrictions

We knew it wasn't going to end well with trading app Robinhood over the $GME (GameStop) shares and $AMC (AMC Theaters) shares skyrocketing because of Reddit -- and a Mr. Robot / Fsociety-fueled stick-it-to-the-man-AND-the-system r/WallStreetBets and millions of normal people around the world like you and I.

Well, now Robinhood has been slapped with a class action lawsuit claims that Robinhood "purposefully, willfully, and knowingly removing the stock 'GME' [GameStop] from its trading platform in the midst of an unprecedented stock rise thereby deprived retail investors of the ability to invest in the open-market and manipulating the open-market".

Get this, with the new limits that Robinhood has introduced -- its users will not be able to buy new stocks of companies such as GameStop, AMC, and BlackBerry -- the very stocks that WSB is pumping right now. You will be able to close out existing trades, but you won't be buying any $GME, $AMC, or $BB in Robinhood right now.

Continue reading: Robinhood hit with class action lawsuit over GME trade restrictions (full post)

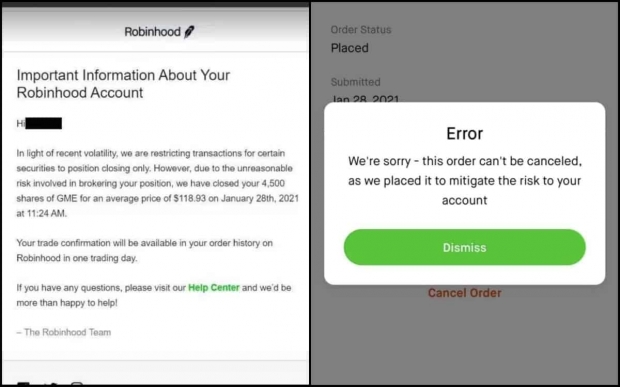

Robinhood halts GameStop trading, sells users stock WITHOUT consent?!

The huge financial drama surrounding the US markets right now with Reddit and its fully viral r/WallStreetBets pushing GameStop and AMC shares through the roof. Well, Robinhood is stopping retail investors from getting in on the wave, and even selling their shares automatically.

Robinhood users began noticing their $GME shares being sold without warning, with Robinhood alerting users that due to "recently volatility, we are restricting transactions for certain securities to position closing only. However, due to unreasonable risk involved in brokering your position, we have closed your 4,500 shares of GME for an average price of $118.93 on January 28th, 2021 at 11:24 AM".

The notice from Robinhood continues: "Your trade confirmation will be available in your order history on Robinhood in one trading day".

Continue reading: Robinhood halts GameStop trading, sells users stock WITHOUT consent?! (full post)

U.S. Senator on GameStop stock shock: Wall Street system is broken

The U.S. Senate will soon weigh in on the eye-opening (and wallet-draining) stock situation booming the market right now.

Individual day traders on the u/wallstreetbets Reddit forum are taking on Wall Street. The upstart sees thousands of traders clash with billion-dollar brokerage and investment firms in a bid to help equalize the market, and short-sellers in particular are being punished. The result of this clash has skyrocketed GameStop stock by more than 600% in a week's time, and AMC stock briefly surged 300% to over $19 today before mellowing out at $9.77.

This bruhaha has caused lots of controversy. Major traders like Robinhood temporarily restricted buying and selling of these volatile stocks. This move was believed to help give brokerage firms time to cover their short positions--or to basically stabilize and freeze trading to give the billion-dollar firms time to buy back their stocks and cover their short bets (here's a primer on what short sales are).

Continue reading: U.S. Senator on GameStop stock shock: Wall Street system is broken (full post)

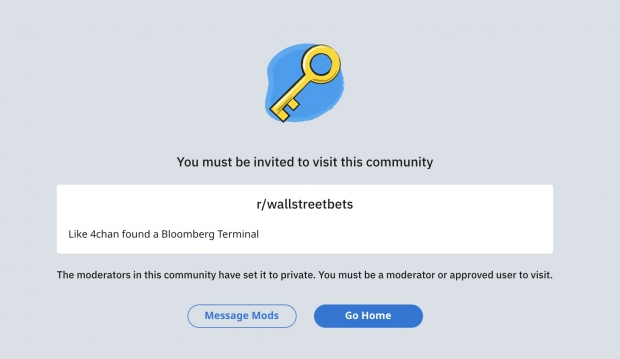

Reddit made r/WallStreetBets private over GameStop stock, back now

I'm sure by now you've heard all about the GameStop share price insanity fueled by Reddit and the r/WallStreetBets subreddit -- if not, I've got some links for you below. If so, things just went up another notch.

The r/WallStreetBets subreddit has had its moderators overloaded since the subreddit exploded in popularity, so much so that it has even seen the official Discord server for r/WallStreetBets being banned for "hate speech". Reddit temporarily turned the lights off to r/WallStreetBets for around an hour not too long ago, making it private -- but now r/WallStreetBets is back.

A post on r/WallStreetBets explains: "The situation here is delicate. Obviously, with the deletion of discord due to ToS violations, the moderators here are dealing with an existential threat to our community. While in the past, automated moderation using bots has been effective for dealing with human users violating the WSB sub ToS, I think a has been reached where the quantity AND quality of posts, primarily by bot accounts, has likely overwhelmed our moderator resources".

Continue reading: Reddit made r/WallStreetBets private over GameStop stock, back now (full post)

Discord shuts down /r/WallStreetBets server for 'hate speech' and more

Discord has shut down the /r/WallStreetBets server, with World's #1 esports and gaming consultant, insider and competitive gaming leader Rod Breslau tweeting:

Discord said that the /r/WallStreetBets server was shut down for "hate speech, glorifying violence, and spreading misinformation" according to a Discord spokesperson to Breslau. The spokesperson added: "To be clear, we did not ban this server due to financial fraud related to GameStop or other stocks".

The company said in full: "The server has been on our Trust & Safety team's radar for some time due to occasional content that violates our Community Guidelines, including hate speech, glorifying violence, and spreading misinformation. Over the past few months, we have issued multiple warnings to the server admin".

Continue reading: Discord shuts down /r/WallStreetBets server for 'hate speech' and more (full post)

AMD reports all-time high revenue for 2020, reports 45% annual growth

AMD had a phenomenal 2020 with the unleashing of the next-gen Zen 3 and RDNA 2 architectures for the PC in Ryzen 5000 series CPUs and Radeon RX 6000 series GPUs -- but that wasn't all.

The company powered the next-gen Sony PlayStation 5 and Microsoft Xbox Series X/S consoles with semi-custom designs made by AMD, packed servers and supercomputers with Zen-powered EPYC processors, and so much more. It should come as no surprise that AMD has posted a new all-time high revenue for FY 2020.

AMD commands 23% of the discrete GPU market against NVIDIA, while record yearly revenues were posted of $9.76 billion, which is up 45% from 2019. AMD has an operating cash flow of $1.07 billion, which is up 117% year-over-year while Team Red also has record free cash flow of $777 million, which is up an astonishing 182% year-over-year.

Continue reading: AMD reports all-time high revenue for 2020, reports 45% annual growth (full post)

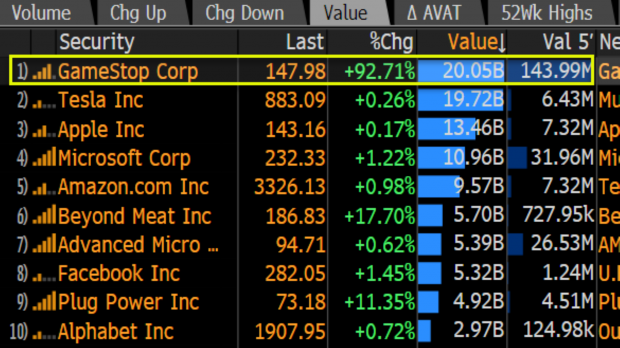

GameStop was the most traded equity today, beating Tesla and Apple

It comes as a big -- and I guess not-so-big surprise -- that GameStop Corp ($GME) was the most traded equity on the planet today with over $20 billion in volume.

The news is coming directly from Senior ETF Analyst for Bloomberg Intelligence, Eric Balchunas, who tweeted the news sand said it was "surreal". GameStop beat out giants like Tesla (just, with Tesla seeing $19.7 billion of trades today) while Apple trails behind with $13.4 billion.

Microsoft is behind even more with $10.9 billion, and Amazon with $9.5 billion. AMD is up there with $5.3 billion traded today, as is Facebook with $5.3 billion and Alphabet with $2.9 billion. GameStop is unstoppable right now.

Continue reading: GameStop was the most traded equity today, beating Tesla and Apple (full post)